Most startups, founders, and employees in the corporate and finance world are probably familiar with the term ‘vesting schedule’. Whether you are looking to have an effective and low-risk management financial plan for your company or to control employees’ share options and retain their commitment, there is a need to understand the concept and significance of a vesting schedule. In this article, we will start with the basics, then look at practical examples of how you or your company can use it.

What is a Vesting Schedule?

A vesting schedule outlines the timeline for when employees can begin claiming benefits such as shares or stocks in the company. This schedule is typically included as a clause in the employee or founders’ agreements or company policies. It may be part of a compensation package, an investment option, or a reward based on performance metrics.

What is the Purpose of a Vesting Schedule?

Companies that offer retirement plans, employee stock ownership plans (ESOPs), or other forms of compensation plans often use them to encourage employee loyalty, commitment, and long-term retention. For example, employees might earn more shares each year they stay with the company. A vesting schedule is meant to encourage people to stay with a company or meet certain conditions before they can fully claim their benefits. In addition, a vesting schedule allows ownership to build up gradually based on continued contribution or time, and protects the company by allowing the company to reclaim shares if a co-founder decides to leave before the period (typically three to four years) within which full ownership is vested.

What Are the Types of Vesting Schedules?

Companies can utilize different types of vesting schedules. We will now discuss this in detail.

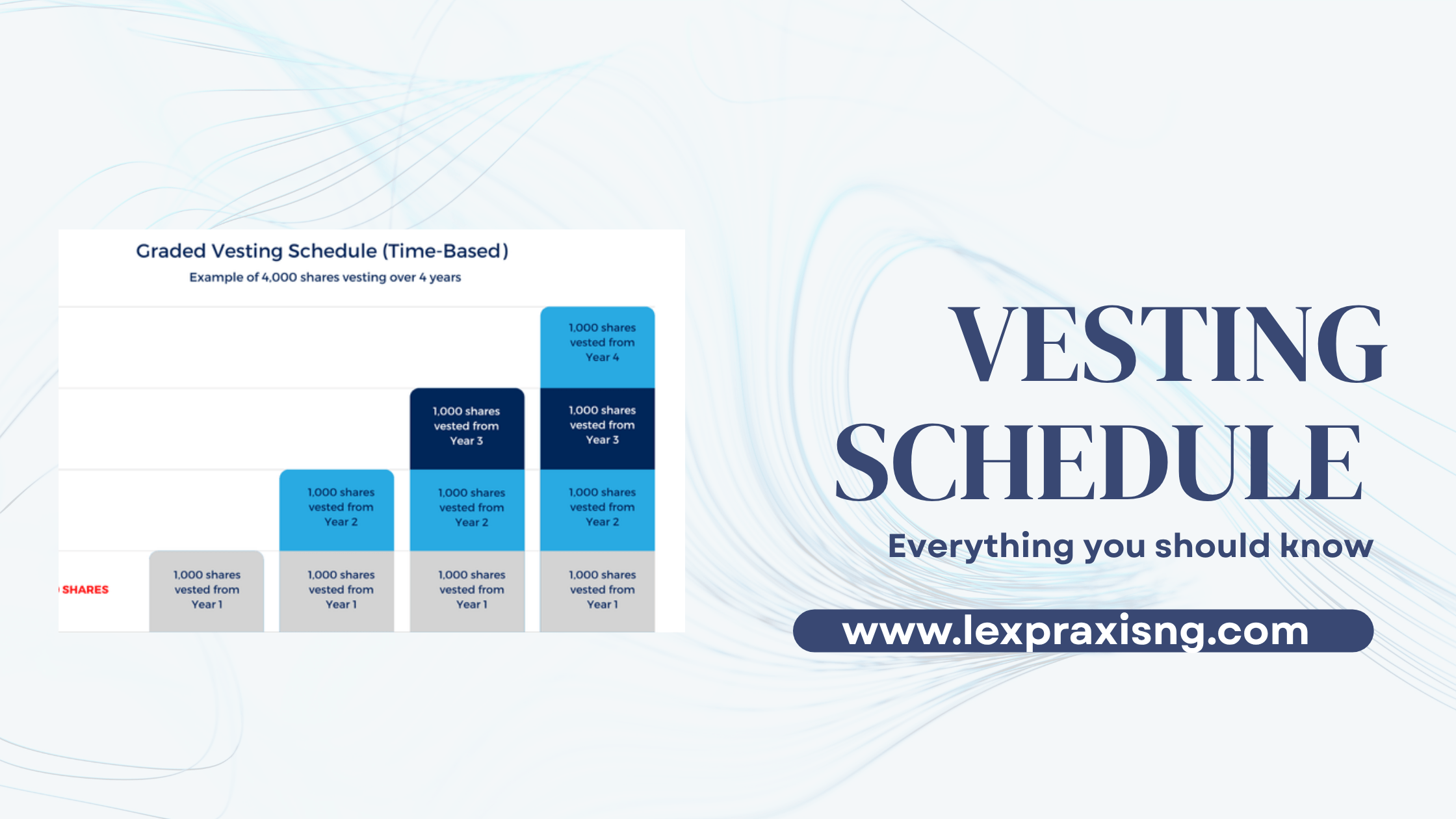

. Graded Stock Option Vesting Schedule

Graded stock option schedules allow employees to earn their shares gradually over time. For example, if someone is given 1,000 stock/share options, they might get 25% each year, which is 250 shares per year. Each time a portion is earned, the employee fully owns it and can choose to keep or sell it. After four years, they own all 1,000 shares. They can reinvest those shares into the company if they want.

- Immediate Retirement Schedule

Immediate retirement vesting gives employees full ownership of employer contributions right away. Funds are added to their retirement account once the set date is reached, usually tied to retirement age. It is a simple and direct vesting plan.

- Milestone-Based Vesting Schedule

Milestone-based vesting schedules give companies a flexible way to reward and keep employees by granting equity as they reach set goals like finishing a project or hitting a revenue target, rather than just over time.[7] It is simply time-based with a performance condition attached to it.

- Hybrid Vesting Schedule

This vesting method combines time-based and milestone-based approaches, requiring employees to stay with the company for a set period and meet a specific goal before they can access their stock options.

- Cliff Vesting Schedule

This type of vesting schedule requires that the employee will not have access to the benefit until the cliff period elapses. Cliff vesting should be for 1 year, 3 years, or 4 years. It must be noted that most companies that employ the stock or share plan usually opt for a 4 year vesting and 1year cliff vesting schedule during which the stock options fully vest after 4 years, but with a 1 year cliff, meaning the employee must complete one full year in the company with access to the stocks or shares of the company before vesting starts over the remaining period.

- Time-Based Vesting Schedule

This type of vesting allows employees to earn stock options gradually, starting with an initial set time before any options are granted, then followed by regular monthly or quarterly grants for the rest.

Which Vesting Schedule is Most Preferred for Startups?

Startups often offer stock options or common shares as part of compensation packages. These grants are given to employees, executives, vendors, or service providers to build loyalty and motivate them to work toward the company’s goals.

Why is a Vesting Schedule Important for Startups?

Vesting schedules ensure that co-founders earn equity over time, prevent early leavers from keeping unearned shares, and protect the startup’s stability and investor confidence.

How Does It Work For Startups?

Vesting schedules are a common way startups reward their early employees or co-founders by giving them a share of the company over time. This helps to build loyalty and ensures that those who benefit from the company’s growth are committed to its long-term success. Let’s look at a practical example to understand how this works for a startup.

SuperTech Solutions, a new tech company in Lagos, has a financial agreement with one of its founders who decides to hire its first employee, Emeka, and decides to give him ownership in the company through stock options. Emeka is offered 4,000 stock options with a 4-year vesting schedule and a 1-year cliff. The 1-year cliff means Emeka must work or be part of the company for at least 12 months before he earns shares in the company. If he leaves the company before completing a year, he gets nothing. In other words, the benefits or shares are reclaimed by the company. But once he completes that first year, 25% of the stock options (1,000 shares) become his; this is known as “vesting.”

After the first year, the remaining 3,000 shares will vest monthly over the next three years. That means Emeka will earn about 83 shares every month until the end of the fourth year. By the end of the four years, Emeka will have fully earned all 4,000 shares. He can now choose to keep them, sell them (if the company allows), or even reinvest them back into the company if he wishes.[14]

Conclusion

Based on the information outlined above, a vesting schedule is essential for companies seeking to retain talent while protecting the interests and objectives of the company. Additionally, it can be used for wills and bequeathing of inheritance, especially where the beneficiary is a minor. Whether time-based, milestone-based, or a hybrid, a well-structured vesting schedule is key to building a committed and balanced team for your company.

For legal advice on how to apply the right vesting schedule for your startup, click the WhatsApp icon to book a consultation or reach out to us HERE, and we will respond to you.