Imagine you have plans to set up a business in Nigeria. You’ve been told there are different types or structures of businesses in Nigeria such as;

- Business name

- Limited Partnership

- Limited Liability Partnership

- Private Company Limited by shares

- Company Limited by Guarantee

- Public Company

- Unlimited Company

Having considered the various types of entities, you opt to register a private company. You’ve been told your company is expected to have a certain number of shares, and you are confused. You have also heard about the shareholders agreement, and you have a lot of questions about shares and the agreement.

Is this you? Not to worry. In this article, we’ll try to answer common questions you might probably have when it comes to the subject of shares for your company registered in Nigeria.

What are shares?

As it relates to companies, shares are simply a portion or unit of ownership rights to a company acquired by a person(s) who own them. Persons who own shares in a company are referred to as shareholders. Shares can be issued by both private and public companies.

What are the type of shares?

In Nigeria, the various types of shares include;

1. Ordinary Shares; This is the most common type of share. Most private companies own ordinary shares. This class of shares has no special rights or restrictions. Ordinary shareholders are entitled to voting rights. They are however the last to be paid in the event a company is wound up or shuts down.

2. Preference Shares; This kind of share has more rights than ordinary shares. As the name implies, preference shareholders earn some form of preferential treatment when yearly dividends are paid by a company to shareholders. Furthermore, in cases where a company is in some form of financial crisis, preference shareholders are entitled to their dividends before ordinary shareholders are compensated. This explains why equity investors opt for this class of shares. However, shareholders with this class of shares are not entitled to an increased dividend when a company records an increase in profit.

3. Deferred shares; As the name implies, the rights of owners of this class of shares are usually deferred until other classes of shareholders are paid or other conditions are met. Scenarios in which deferred shareholders’ rights come to play include;

- Shares in which dividends are only paid after all other classes of shares have been paid

- Shares in which dividends are paid only after a certain date or event

- Shares that are not tradable until a certain date – such shares are usually issued to employees in order to give them a long-term interest in the company and to increase their loyalty

- Shares that, in the event of insolvency, do not give their holders any rights until all other shareholders are paid

3. Cumulative Shares; Owners of cumulative shares have a right that guarantees payment of dividends by a company in a subsequent year where a company fails to pay dividends in a financial year.

4. Redeemable Shares; Under this class of shares, a company issues shares to its shareholders with a written agreement that the company has the right to buy back the shares at a future date (either a fixed date or a date determined by the company). Companies cannot issue this kind of share to their shareholders alone, such class of shares must be issued alongside other classes of shares.

Do shareholders get paid monthly for owning shares?

Shareholders are paid by way of dividends. As a matter of practice, dividends are paid quarterly and annually. Only a few companies are able to pay dividends on a monthly basis. It all comes down to the capacity of the company to pay dividends frequently.

How many shares is my company expected to have for a start?

In Nigeria, the number of shares a company is required to start with during registration depends largely on several factors. For instance; are the founders of the company foreigners? What is the proposed nature of the business activity of the company? Is the company contemplating raising funds by way of equity investment from investors? Etc.

There are minimum share capital requirements for some of the scenarios raised above. That is why we encourage individuals who are contemplating setting up their companies in Nigeria to seek legal guidance from business or corporate law experts in Nigeria to avoid critical mistakes during the company formation process.

Do I have to pay every amount stated in my statement of share capital during registration?

No, you do not. Depending on the amount of shares promoters of a company agree on, the company will be required to pay stamp duties and company registration charges which are accessed based on the number of shares stated.

Therefore, if a newly formed company decides to declare one million Naira as its share capital, for instance, the company will not be required to provide a sum of one million Naira to the authorities during registration. Such a company will only be accessed based on the share capital amount stated.

What is a shareholders agreement?

A shareholder’s agreement is a document that states the rights and obligations of shareholders of a company amongst themselves and between themselves and a company. It also outlines the operations of such a company toward its shareholders.

Why is a shareholders agreement important?

A shareholder’s agreement is important for several reasons;

1. The memorandum and articles of association of a company, which serve as a constitution of the company do not address extensively the rights and obligations of shareholders. A shareholder’s agreement provides in detail, circumstances which may occur amongst shareholders and a company and makes provision for how such issues will be addressed. A shareholder’s agreement is made to serve as a complement to a company’s Articles of Association.

2. Shareholders’ agreements are flexible and easy to amend and make changes whenever the need arises. This is however not the case with a company’s Memorandum and Articles of Association which requires a special resolution of members of a company as well as filing with the Corporate Affairs Commission to make an amendment or alteration.

3. Contents of a shareholder’s agreement are confidential as a shareholder’s agreement is made for only parties to the agreement. On the other hand, a company’s Memorandum and Articles of Association are public documents and could easily be accessed by third parties.

When should my company consider having a shareholder’s agreement?

During the process of formation. It can also be amended to reflect changes that may occur during the company’s lifetime such as;

1. When a shareholder dies or wishes to sell his or her shares

2. When shares are issued to new shareholders

3. When a company borrows money from a shareholder, etc.

What matters are addressed in a shareholder’s agreement?

A standard shareholders agreement addresses issues such as;

1. What is expected to happen in circumstances where a shareholder wishes to sell or transfer his/her shares to a non-shareholder? How will such a transfer be done in a way that the transfer isn’t made to an unwanted third party and thereby affect the company negatively?

2. How will future capital contributions towards the company and funding be made?

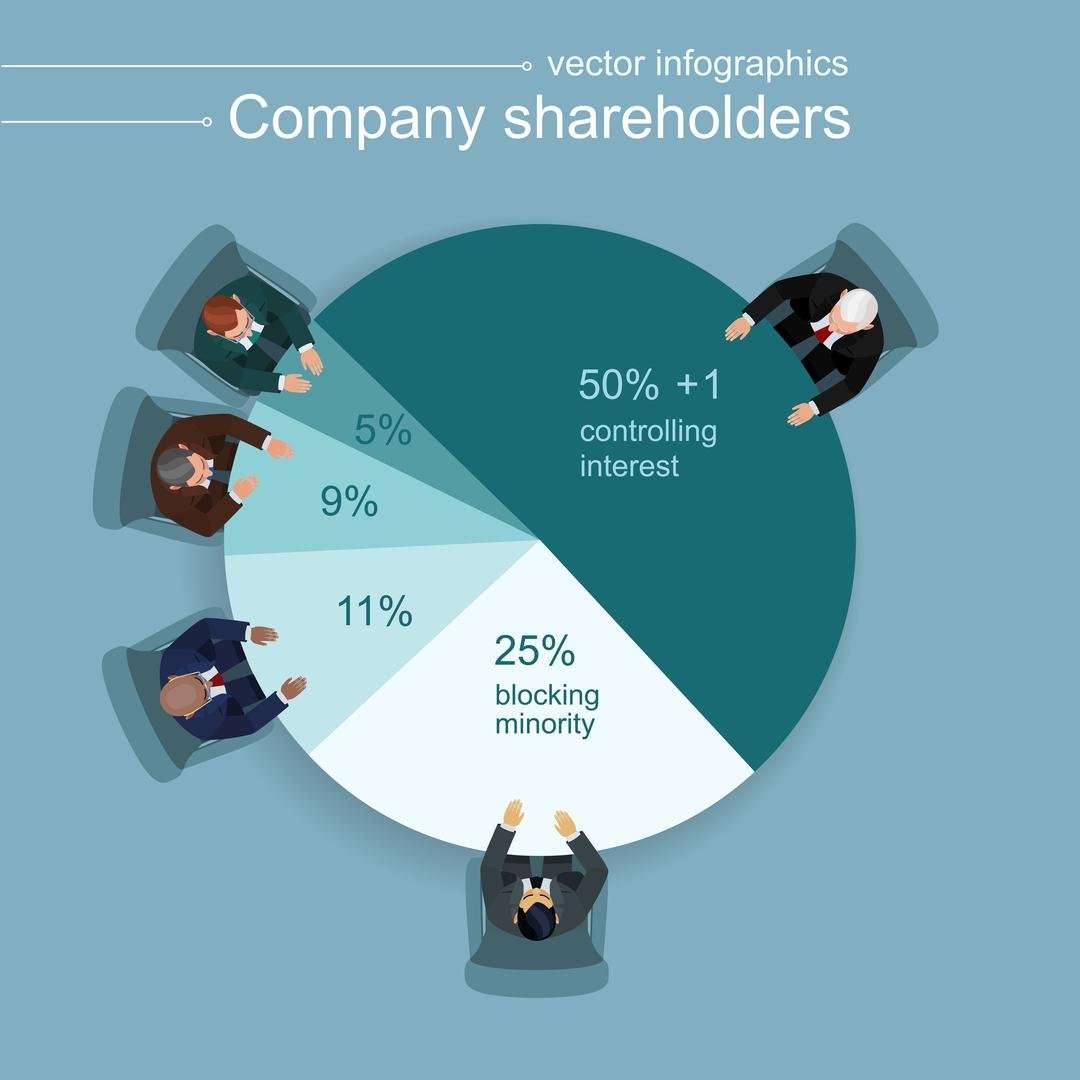

3. How will the interest of shareholders within the company who own few shares or fewer rights from their shares be protected?

4. How will disputes amongst shareholders and between shareholders and the company be handled?

5. How will the interest of the company be protected from competition by shareholders who are exposed to the company’s trade secrets and wish to carry out similar business activities? Etc.

Is there a standard template for a shareholder’s agreement?

From experience, the circumstances that give rise to the need for shareholder agreement are peculiar and vary from one company to another. Although there are templates available online, unfortunately, these templates are not designed in a manner that takes note of such peculiar circumstances, and as such, it is difficult to find a standard template.

That is why we encourage founders and individuals in need of a shareholder’s agreement to seek the services of business law experts to assist them with preparing a shareholder’s agreement that addresses the peculiar nature of their business needs.

Next Steps

If you are in need of legal guidance with respect to setting up a company in Nigeria, setting up a Shareholding structure for your company, or preparing a shareholder’s agreement, our team of lawyers are always on standby to understand your business’ peculiar need and assist your company with preparing its shareholder’s agreement.

You may reach out to us HERE or through the Whatsapp icon on your right and we will be delighted to assist you.