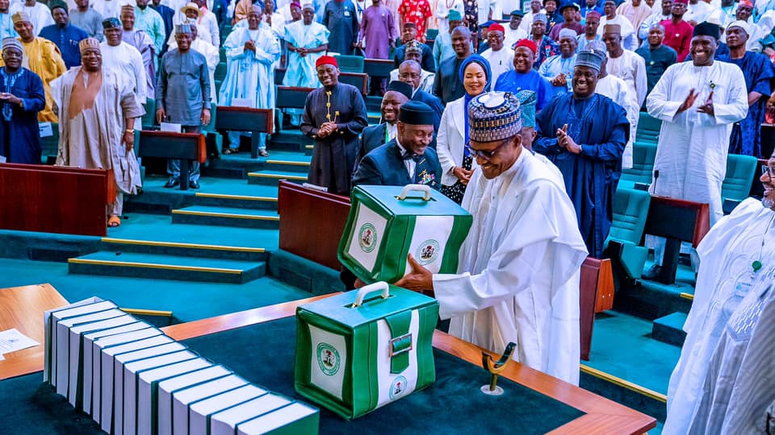

In October 2019, President Muhamadu Buhari presented a Finance Bill to the National Assembly, to amend the various tax laws in Nigeria. The bill was presented with the following objectives;

- Promote fiscal equity

- Reform domestic tax laws to align with global best practices

- Introduce tax incentives for investments in infrastructure and capital markets.

- Support MSME’s and

- Raise revenues for the government.

In November 2019, the Bill (after a public hearing) was passed by the Senate of the Federal Republic of Nigeria after the third reading. According to legislative procedure, the Bill must in addition, be passed by the House of Representatives before it is presented to the President for assent to be signed into law. With the swift and smooth sail the Bill has had so far, there are high chances that this Bill will be signed into law soon.

No doubt this Bill has raised a lot of concerns as it is common knowledge that the intent of the Bill is to draw more taxable persons and organizations into the tax net. However, it will interest you to note that this Bill if passed into law, will attract good tax incentives to Micro, Small and Medium Scale Enterprises, hence this post.

BENEFITS OF THE FINANCE BILL FOR MICRO, SMALL AND MEDIUM SCALE ENTERPRISES.

It is an established fact that MSME’s are the backbone of sustainable growth in any economy including Nigeria. Currently, there are estimated to be about 41.5 million MSME’s in Nigeria, with Lagos, owning a large proportion.

Unfortunately, MSME’s are largely affected with numerous concerns especially that of multiple taxation. To this intent, the Finance Bill seeks to address these concerns and we believe with the right measures and implementation policies in place, it will do just that.

In no particular order, below are some of the benefits the Finance Bill will put into place;

- Small companies earning below N25, 000, 000 (twenty five million naira) as annual turnover in a tax year will be generally exempt from remitting company income tax. However, companies with an annual turnover of above N25, 000, 000 (twenty five million naira) but less than N100, 000, 000 (hundred million naira), are entitled to tax relief of company income tax rate of 20% as against the current 30% rate.

It’s important to note that these tax exemptions and reliefs applies so long as such company complies with regulations as regards tax filing and remittance within the stipulated time frame.

In addition, large companies (with annual turnover greater than N100,000,000) and medium sized companies(with annual turnover between N25,000,000 and N100,000,000), that remit CIT payments on or before 90 days from the due date of filing will be entitled to a bonus of 1% and 2% respectively.

- SME’s with threshold turnover of below N25,000,000 (twenty five million naira) would not need to register for Value Added Tax (VAT), or include it in their charges to customers.

Furthermore, the age long debate as what qualifies as “basic food items” and “exported services” in relation to VAT exemption has been put to rest. Under Section 45 of the Bill, “basic food items” has been included to mean; agro and aqua based staple foods such: additives, bread, cereals, cooking oils, culinary herbs, fish of all kinds, flour and starch, fruits, live or raw meat and poultry, milk, nuts, pulses, roots, salts, vegetables, water.

“exported services” has been interpreted to mean; “… a service rendered within or outside Nigeria by a person resident in Nigeria to a person resident outside Nigeria. Provided, however, that a service provided to the fixed base or permanent establishment of a non – resident person shall not qualify as exported services”.

- Stamp duties on receipts including that of electronic transactions (which has been increased to N50) will apply only to transactions above N10,000 (ten thousand naira only). It’s important to note that what is currently practiced is that stamp duties are charged on transactions above N1,000 (one thousand naira). However, if this bill is signed into law, the threshold will be increased to N10,000 (ten thousand naira). This would no doubt, reduce the challenges faced by SME’s who have recently transferred the N50 (fifty naira) as an additional cost to customers.

CONCLUSION.

It’s clear that a large amount of incentives provided in this Bill are targeted at SME’s. It is hoped that with the right implementation policies in place, this Bill to foster the desired ease of doing business in Nigeria.

Best Oil For Hair Growth

This is very interesting. thanks for that. we need more sites like this. i commend you on your great content and excellent topic choices.

Cynthia Tishion

We're glad you found the content useful. Thank you.

Oil For Hairfall

Awesome post. I am a regular visitor of your web site and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a long time.

Anyrepair

FINANCE bILL are very important for F micro,small and medium scale business.